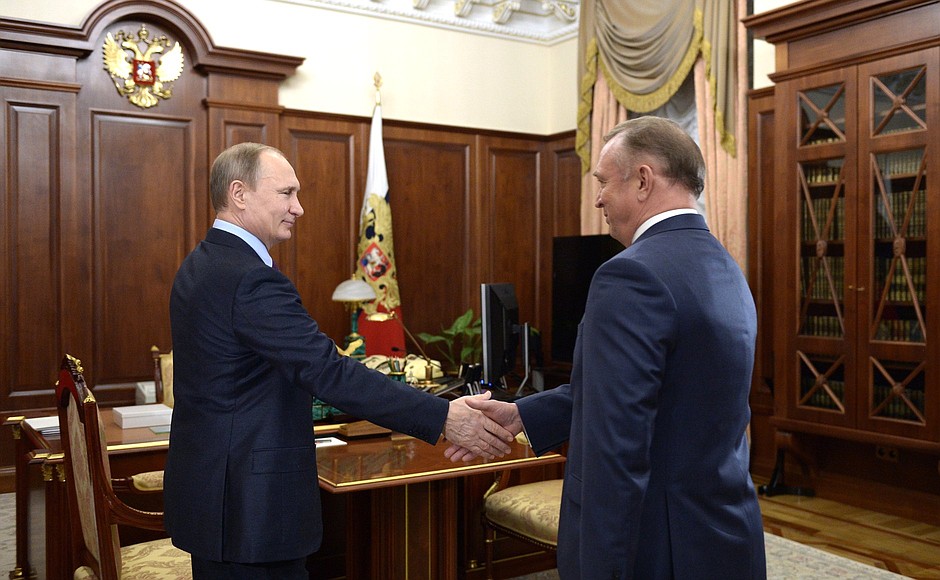

President of Russia Vladimir Putin: Mr Katyrin, the Chamber of Commerce and Industry is probably the most representative agency, the largest organisation that brings together the greatest number of Russian companies, including small and midsize businesses. In speaking with your colleagues in this broad organisation, what mood are you sensing? What problems do you discuss most often?

I know that you meet often to discuss the tax burden. Just recently, I believe you had a forum on this issue.

President of the Chamber of Commerce and Industry Sergei Katyrin: Mr President, indeed, our traditional tax forum was held just recently. We gather annually, primarily with participation by businesses, and invite representatives from ministries, departments, the tax service and deputies. So it is a fairly broad gathering.

This year, we had a great deal of discussions on so-called non-codified non-tax levies. In other words, the taxes that are not regulated by the Tax Code.

We conducted a special study in 15 of Russia’s regions in preparation for this forum. As of today, we have found over 50 such non-tax, non-codified levies. This is a very serious burden on businesses. It is very serious in terms of the amount of taxes, although our experts say that this is certainly not an exhaustive list. If we count carefully, including at the local and regional level, there are even more. Granted, we tried to take into account some of the regional levies.

This work was conducted in part due to requests by businesses that appealed to us, and this concerns businesses of all sizes. I want to stress, Mr President, that large companies are also quite concerned by this burden, and it affects small and midsize businesses even more.

Currently, according to our calculations, the scale of these levies is close to one percent of the GDP. In their essence, they are close to what could be called taxes – they are public, mandatory and non-refundable. For all intents and purposes, this is like an emerging second taxation system. Having analysed the situation, we have prepared suggestions that I would like to summarise for you now.

First, we believe it is imperative to pass a legislative act, a law, to regulate procedures for the adoption, foundation, the procedures and method of calculation, administration and so on – all the issues pertaining to these types of payments.

Second, we feel it is imperative to create a register for such tax payments, and entrepreneurs should not be obligated to make payments that are not included in that register.

Vladimir Putin: For example?

Sergei Katyrin: We have many payments, incidentally, analogous ones. For example, ports collect a tonnage tax, a lighthouse signalisation fee and a navigation tax. For the environment, there is an environmental tax, a recycling tax and so on.

Vladimir Putin: So the burden increases, and there is essentially no oversight over how this happens?

Sergei Katyrin: Exactly. No procedures for calculation, no scale for calculation, no administrators. After all, we have different administrations for nearly each levy. Sometimes, with such payments, for example, the port charges are collected by different administrators, which is naturally difficult for entrepreneurs, as well as for the government, which maintains all this.

So we feel it is imperative to introduce such a register – if levies are included on the register, then entrepreneurs pay them, and if they are not, then they do not pay. We recommend instructing the Finance Ministry to implement such a register so that it monitors it the same as finances. This will help the government to actually have a clear understanding of this entire system of payments. Many of them are necessary, of course, it is impossible to do without them, everyone accepts that, but the scale and amount – there is much here that should be united.

Moreover, the government will have the opportunity to monitor them, while businesses will have the opportunity to participate in determining what should be included in this register and engage in discussions on this topic.

Furthermore, we feel that the government also has an opportunity to monitor the way that these payments are spent. If they are included in the register, if the legislation is regulated then we can look at how acceptable it is in scale and purpose, and where those payments are going.

We also believe this would be an opportunity opportunity to combine several payments and have a single administrator. This will reduce the number of such payments, combine similar ones, and reduce the number of administrators working in these areas.

We have prepared corresponding suggestions, Mr President, and would like to ask you to instruct the Finance Ministry jointly with the Agency for Strategic Initiatives (we are prepared to participate in this work as the initiators of these ideas) to prepare a roadmap by mid-summer to bring about order in all these affairs. Of course, any new levies must not have retroactive effect and their introduction should be announced in advance, so that a new tax is not introduced the following day. Businesses should be given the opportunity to prepare for it. It could be introduced from January 1 of the following year, for example.

These are the measures we are proposing. We will do a certain part of the work ourselves and are prepared to take part, if you agree with this and issue such instructions. The proposals are set out in written form, I have them with me.

Vladimir Putin: Of course, I agree. We will certainly look into this in more detail; after all, businesses ultimately do not care whether the fiscal burden comes from a tax or a non-tax payment – there is no difference.

Sergei Katyrin: You are absolutely right.

Vladimir Putin: Nothing is achieved if we say that we will not raise taxes but increase the fiscal burden by calling it something else. The government must certainly look at this aspect of business operation, and make it transparent, clear and non-burdensome. So let’s go ahead.

<…>